Diversify Your Portfolio….of Partners

I’m no investment consultant, but I know a little bit about diversification — it’s the practice of spreading investments around so that your exposure to risk associated with any one asset or category is limited. A typical diversified portfolio contains a mix of fixed income, stocks and commodities — these assets react differently to the same economic event, protecting you from losing everything in an isolated financial crisis.

Much like your personal finance portfolio, without diversification, your affiliate program could be at risk. I‘m fortunate to travel and meet with businesses across the globe and the consistent concern I hear is that revenue growth is driven by only a handful of affiliate partners — and it’s a legitimate concern. For one, over-reliance on any one partner type or one method of promotion puts your business at the risk of exhausting a particular customer base. But what happens when a relationship gets strained and your promotion gets pulled? This is when diversification of partnerships saves the day.

Types of partnerships to consider

So, what type of partners should you be adding? Well, for starters, note that I used the word “partners” and not affiliates — they’re different. I define affiliates as those whose business model revolves around CPA, like big coupon or loyalty sites, for example. They’re plug and play; they know exactly how to work with you in affiliate marketing and have a tried, tested and profitable way to help you grow your business.

Partners, on the other hand, may be new to performance marketing. Think of your B2B partners, influencers, or mobile app publishers: payment models may be different, the platforms (or spreadsheets) you use to manage or measure them may differ, and they may be managed by a different department in your company. But just think of how much larger your audience can become by leveraging these new partner types.

Earlier this year, my company conducted a commissioned study with Forrester to explore the benefits of partnership programs and what they provide to businesses in terms of revenue and other business objectives. To no surprise, it confirmed that companies with mature partnership programs grow total revenue nearly 2X faster than those with less mature programs (representing $162M more on average), and generate almost 30% of their total revenue from partnerships.

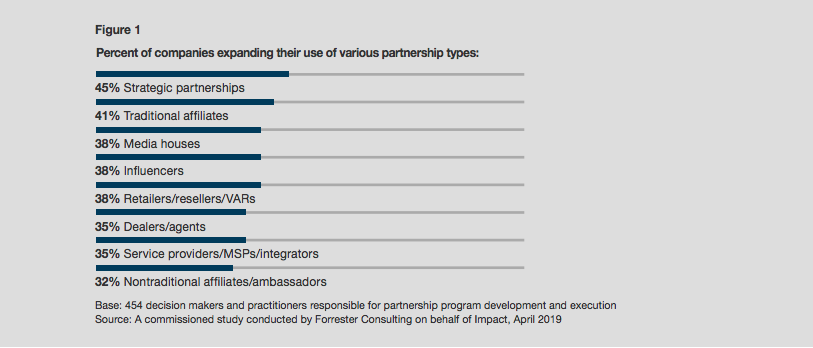

We also wanted to know how successful businesses approach the concept of diversification or “breadth” of their partners. What we found was pretty telling – with a diverse portfolio of partnerships in mind, successful companies market their programs broadly but recruit selectively. They target a range of partnership types, from traditional affiliates, to media houses, to dealers and agents.

We also wondered what types of partnerships companies were looking to expand on – and strategic partnerships took the top spot, followed by affiliates, media houses, influencers, retailers/resellers/VARs, dealers or agents, service providers or MSP’s and lastly nontraditional affiliates or ambassadors. (see chart below).

Summary

You should be strongly exploring these and other new partnership types. Just like in financial planning, laying out a risk-averse partnership strategy is wise. Not only does it mitigate the concentration risk typically found in most affiliate channels, it also provides for increased growth and reach.

Follow

Follow